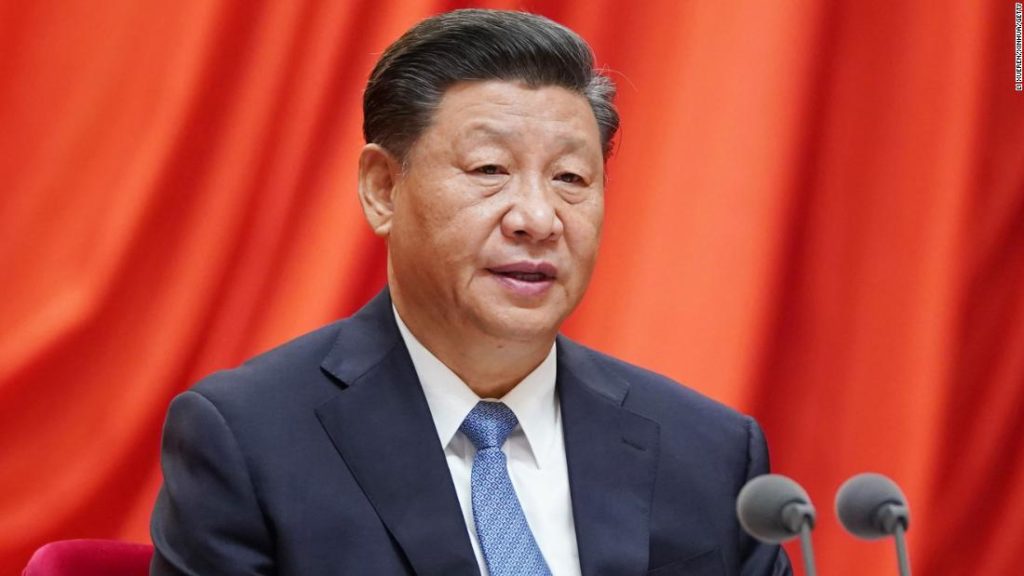

President Xi Jinping has already made it clear that he sees China taking pole position in the coming year and beyond.

And he touted China’s ability to propel the global economy by injecting “more momentum into growth.”

China will “leverage its big-market advantages and the potential of domestic demand to provide more opportunities for cooperation between countries and the global economic recovery,” Xi said.

Xi was certainly projecting confidence, said William Reinsch, a trade expert at the Center for Strategic and International Studies (CSIS) who served for 15 years as president of the National Foreign Trade Council.

But a host of geopolitical challenges — including clashes over Hong Kong and alleged human rights abuses in China’s Xinjiang region — have exacerbated tensions with the West and may stymie efforts to foster multilateral cooperation.

“[Xi] is squandering China’s global influence through increasingly provocative actions in Xinjiang, in Hong Kong, in the South China Sea, and with respect to Taiwan,” Reinsch told CNN Business. “These actions are unacceptable to democracies, and I think we will continue to see them pulling away from China despite its attractiveness as a market,” he added.

‘Confidence in China’

“In and out of lockdown ahead of everybody else, the Chinese economy powered ahead while much of the world was struggling to maintain balance,” wrote Frederic Neumann, co-head of Asian economics research at HSBC, in a report last week.

Given China’s rapid growth over the last few decades, many economists were already predicting that it would overtake the United States some time after 2030. But the country’s ability to weather the pandemic is accelerating that trend.

Chinese state media — often seen as a barometer of sentiment among senior officials — has been touting the country’s economic success. The Global Times, a state-run tabloid, on Sunday seized on the report from the United Nations Conference on Trade and Development that showed China receiving more foreign direct investment than the United States last year.

The investment trend will likely flip back as the United States and Europe recover, according to Dan Blumenthal, the director of Asian studies at American Enterprise Institute.

“[Foreign] companies will be squeezed out over time by Chinese competitors and China’s panoply of anti-competitive practices,” he said. “Still, given China’s scale and ambition it is a formidable competitor to the US.”

Challenges ahead

China isn’t without its challenges.

“The policy response to the Covid-19 pandemic, while effective in the short-run, is pushing more resources to inefficient state firms and will add to China’s debt burden,” wrote Julian Evans-Pritchard, senior China economist at Capital Economics, in a research report last week.

Debt woes have followed China for years, casting a shadow over economic policy.

Ma even suggested that Beijing should abandon nationwide GDP goals, and instead prioritize employment and controlling inflation.

Biden “has prioritized combatting Covid and restoring growth to our economy, but he is at heart a multilateralist,” said Reinsch of CSIS. “Once he has made progress on his domestic goals, he will turn his attention to global trade issues as well.”

— Laura He contributed to this report.

You may also like

-

Afghanistan: Civilian casualties hit record high amid US withdrawal, UN says

-

How Taiwan is trying to defend against a cyber ‘World War III’

-

Pandemic travel news this week: Quarantine escapes and airplane disguises

-

Why would anyone trust Brexit Britain again?

-

Black fungus: A second crisis is killing survivors of India’s worst Covid wave