This article was updated following the auction of Beeple’s “Everydays: The First 5000 days,” which sold for $69.3 million.

This week, a compilation of over 13 years’ worth of the artworks, collectively titled “Everydays: The First 5000 days,” sold for $69.3 million via Christie’s, putting Winkelmann’s name among some of the art market’s most valuable living artists.

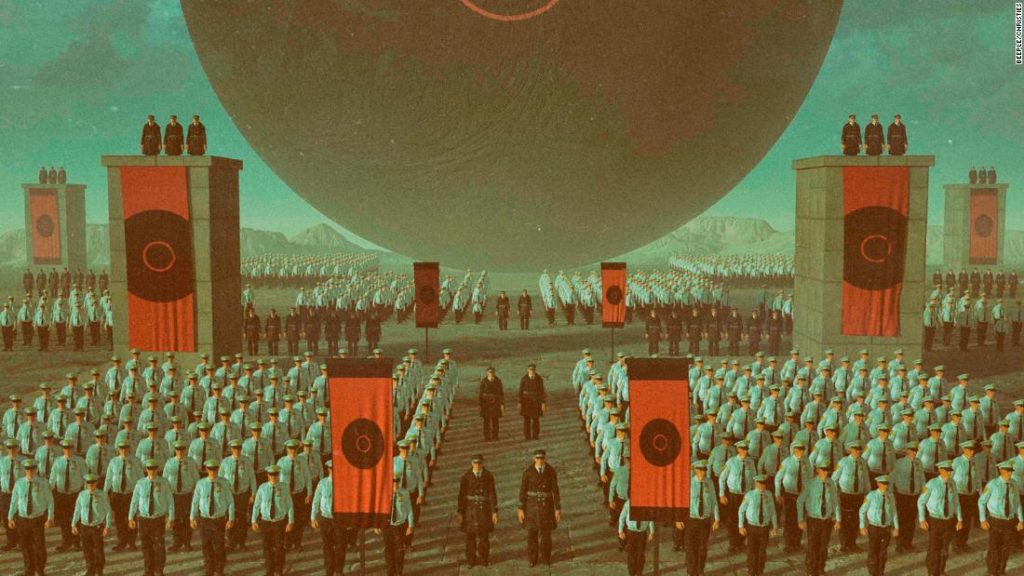

A multi-million-dollar auction for Beeple’s “Everydays: The First 5000 days” closed this week at $69.3 million. Credit: Beeple/Christies

“It’s a bit surreal, because (digital imagery) wasn’t really something that I pictured, in my lifetime, being able to sell,” said Winkelman, who goes by the name Beeple, in a video call from his home in South Carolina ahead of the sale. “So it (has) come out of nowhere. But at the same time, I also really feel like this is going to be the next chapter of art history.”

At the center of this explosion in transactions are non-fungible tokens, or NFTs. Acting like virtual signatures, they address concerns that digital art’s value is diminished by the ease with which it can be copied or lost.

While an oil painting can only be displayed in one place and has a definitive owner, a digital image, video or gif can be infinitely duplicated and enjoyed on screens around the world for free. This has often posed problems for prospective collectors, who don’t know how to price digital art and fear it will lose resale value. But now, NFTs are offering two things that the physical art market has always depended on: scarcity and authenticity.

The rise of ‘non-fungible’ tokens

NFTs are built on blockchain technology, which — just as it does with Bitcoin — offers a secure record of transactions. This digital ledger serves as incorruptible proof of ownership, meaning that “original” artworks and their owners can always be identified via the blockchain, even if an image or video is widely replicated.

A “fungible” asset is one that is that can be replaced with another identical one of the same value, such as a dollar bill, while non-fungible one, like NFTs, are tied to unique goods and are not mutually interchangeable.

Like bitcoins, the tokens can be kept in a virtual wallet. They can then be sold or traded, often gaining value in the secondary market. This makes NFT artworks similar to physical ones — or any other real-world asset, according to Duncan Cock Foster, co-founder of Nifty Gateway, the platform behind Beeple’s and Grimes’ recent multi-million-dollar sales.

“We have systems for collecting paintings, and we have systems for collecting sculptures. But until now, people hadn’t figured out a good way to collect digital art — and NFTs allow you to do that,” Cock Foster said on a video call, adding that buying tokens is easier and “a lot more accessible” than traditional art collecting.

Related video: Just how much has the internet changed art?

On Nifty Gateway, artists set the number of editions for any single artwork by deciding how many accompanying tokens will be made available. This can range from one-offs, where a piece is sold to a single collector, to open-edition “drops,” where tokens are made available for a limited period of time.

By connecting artists directly to collectors, NFTs effectively cut out galleries and other traditional gatekeepers. While Cock Foster would not disclose the size of Nifty Gateway’s cut, he claims it is “far less” than what a gallery would usually take.

For Beeple, this represents a “democratization” of the art market. “Now I have direct access to my audience,” he said. “I don’t have to go through an intermediary.”

One of digital images that Beeple produced daily from 2007. Credit: Beeple/Christies

So, while Beeple made less than $67,000 when he originally sold his “Crossroad” animation, he pocketed a further $660,000 when the initial buyer sold it on.

“The royalties are definitely something that make this much more sustainable and equitable for all parties,” the designer said.

New breed of collector

The collector behind the $6.6 million “Crossroad” sale, Pablo Rodriguez-Fraile, said that supporting creators is one of the unique benefits of investing in NFTs. While there is money to be made, and plenty of speculation happening in the crypto art market, the 32-year-old said that collecting digital works is about more than money.

“I try to look into the life and career of the creators. I like to get in contact with them and meet them … for me, it’s important to see consistency and thoughtfulness about everything outside the art as well,” said Rodriguez-Fraile on the phone, adding that he is drawn to works that are “masterfully executed.”

Beyond “Crossroad,” Rodriguez-Fraile said he has collected hundreds — perhaps thousands — of NFT artworks, selling only a handful so far.

Beeple’s art often plays with pop culture icons in grotesque and unexpected ways. Credit: Beeple/Christies

While the Miami-based collector was previously interested in blockchain and cryptocurrencies, were it not for NFTs, he said he would not be involved in buying art. His experience, like Beeple’s, suggests that the tokens are empowering a new breed of artists and collectors rather than taking a slice of the existing art market.

“The analogy I like to make is Uber,” Cock Foster said. “When they were trying to make a forecast for Uber’s market size, they looked at the amount of money people spent on black cars (private car services). But because it’s so much easier to call an Uber than it is to call a black car, the actual market ended up being much larger than that. I really think we’re seeing something similar with NFTs.

“They are lowering the barriers to collecting significantly,” added Cock Foster, whose platform operates under the ambitious tagline, “We will not rest until 1 billion people are collecting NFTs.”

Future prospects

Nifty Gateway may be a long way from its goal of 1 billion collectors, but the platform’s growth nonetheless reflects exploding interest in crypto art. In March 2020, the site recorded monthly transactions of $30,000; last month, this figure was up to $75 million, according to Cock Foster.

This jump broadly coincides with another major force in the art world: Covid-19. With galleries and auction houses shuttered around the world — and people spending more time browsing the web or shopping online — NFTs have offered a new outlet for art enthusiasts.

According to Beeple, this is why interest in the tokens has skyrocketed in recent months, even though the technology has been available since 2017.

“You keep hearing that Covid has pushed things 10 years forward, and I think this honestly is a big part of it,” he said. “Everybody was sitting at home over the last year — so while I think this was inevitable, it really got accelerated.”

This rapid growth has led to fears of an NFT bubble — one that may burst when the world emerges from pandemic-era restrictions. While collector Rodriguez-Fraile believes that “NFTs are here to stay,” he accepted that “we might be going through a period of hype … and I think the general ecosystem might slow down a bit when it comes to pricing.”

For Cock Foster, however, the return to normality presents opportunities rather than threats — not least because galleries offer ways to experience digital art beyond a computer screen.

“Digital art is very, very immersive,” he said, adding that displaying art is still important to online collectors. “So, I think we can build some really cool physical experiences.”

This article was updated to reflect the final amount generated by Grimes’ NFT drop.

You may also like

-

Afghanistan: Civilian casualties hit record high amid US withdrawal, UN says

-

How Taiwan is trying to defend against a cyber ‘World War III’

-

Pandemic travel news this week: Quarantine escapes and airplane disguises

-

Why would anyone trust Brexit Britain again?

-

Black fungus: A second crisis is killing survivors of India’s worst Covid wave